St. Augustine, Fla., Nov. 4, 2015—Eleven Solar Stik® products are now eligible for the U.S. Internal Revenue Service’s Residential Energy Efficient Property Credit, and in service to its customers, Solar Stik, Inc. has posted the Manufacturer’s Certification Statement on its website.

Beginning on Jan. 1, 2009, those who have purchased or plan to purchase qualifying items from Solar Stik for residential service through Dec. 31, 2016, may be eligible for a 30-percent tax credit on their federal income taxes.

The tax credit also is available to those who have purchased eligible products for motorhomes and sailboats that qualify as second residences, and includes the labor costs associated with installation.

“This is not only a great credit for our customers who have already purchased Solar Stik products, it’s also a great incentive for those considering the element of ‘self-sufficiency’ for their boat or RV… solar and wind generation can add a lot of freedom to the mobile lifestyle!” said Brian Bosley, CEO of Solar Stik.

If the federal tax credit exceeds tax liability, the excess amount can be carried forward to the succeeding taxable year until 2016. Complete program details are available at http://www.energystar.gov/about/federal_tax_credits.

Solar Stik products qualifying for the tax credit are:

- Marine Solar Stik 100 Transom Mount

- Marine Solar Stik 100 Deck Mount

- Solar Stik 100 Lite

- Solar Stik 200 12VDC

- Solar Stik 200 24VDC

- Solar Stik 400 12VDC

- Solar Stik 400 24VDC

- Wind Stik 160

- Breeze Mast Upgrade 12VDC

- Breeze Mast Upgrade 24VDC

- Breeze Mast Upgrade 24VDC (painted)

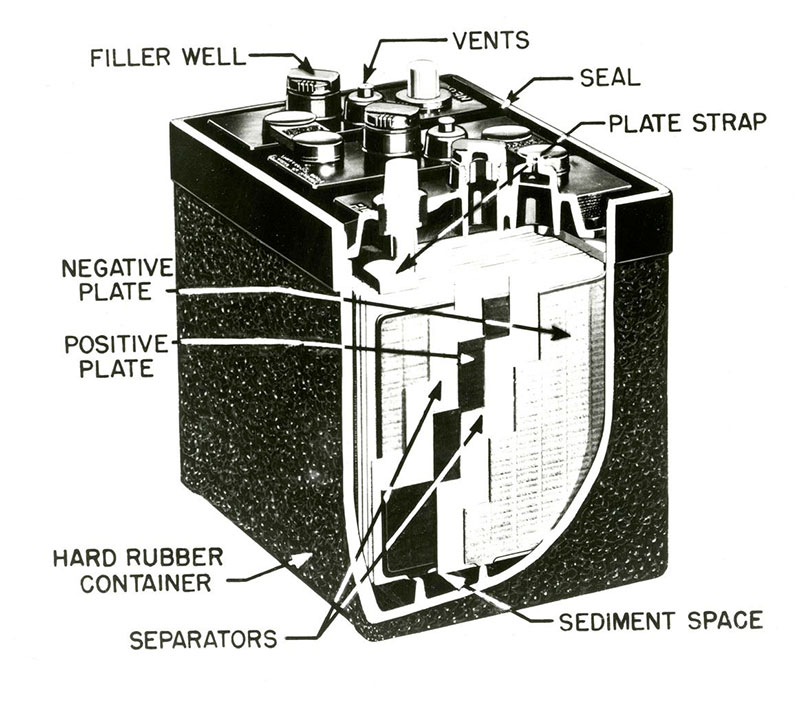

Solar Stik is a leader in the portable renewable power industry. The company manufactures renewable energy power generators, battery storage systems, power management devices, and integrated hybrid power solutions.

For more information please contact us at +1 800.793.4364.